How Is Ai Being Used To Improve Customer Service In The Financial Industry?

Contents

Overview of AI in Buyer Service: How Is AI Being Used To Enhance Buyer Service In The Monetary Business?

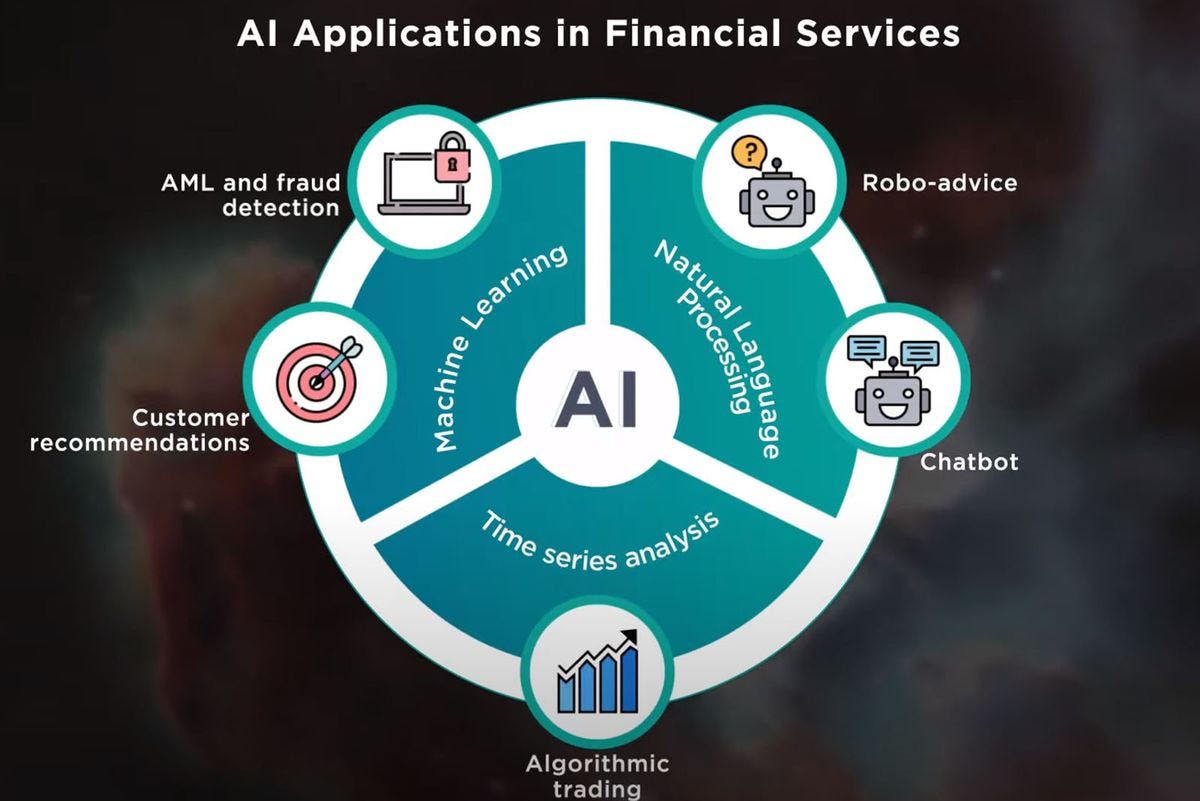

AI has been instrumental in remodeling customer support within the monetary business by offering environment friendly and personalised interactions. Applied sciences like chatbots and voice assistants have revolutionized the way in which prospects have interaction with monetary establishments, providing round the clock help and fast responses to queries. These AI functions have considerably improved customer support effectivity and effectiveness by automating routine duties, offering instantaneous options, and enhancing general buyer satisfaction.

Function of Chatbots in Buyer Service

Chatbots are AI-powered digital assistants that may have interaction with prospects in real-time, answering questions, offering account info, and even helping with transactions. These chatbots can be found 24/7, providing instantaneous help and lowering response occasions for buyer inquiries. For instance, Financial institution of America’s chatbot, Erica, helps prospects handle their funds, make funds, and observe spending habits via pure language interactions.

Voice Assistants in Buyer Interactions, How is AI getting used to enhance customer support within the monetary business?

Voice assistants like Amazon’s Alexa or Google Assistant have additionally been built-in into monetary providers to reinforce buyer interactions. Clients can use voice instructions to verify balances, switch funds, or inquire about current transactions with out having to navigate via complicated menus. These voice-enabled providers present a hands-free and handy means for purchasers to entry banking providers, making transactions extra accessible and user-friendly.

Customized Suggestions and Insights

AI algorithms analyze buyer knowledge to offer personalised suggestions and insights tailor-made to particular person preferences and monetary targets. As an illustration, AI-powered programs can counsel appropriate funding choices, alert prospects of potential fraudulent actions, or supply budgeting ideas primarily based on spending patterns. By leveraging AI applied sciences, monetary establishments can ship a extra personalised and proactive buyer expertise, in the end constructing stronger relationships with their purchasers.

Customized Buyer Experiences

AI performs an important function in revolutionizing buyer experiences within the monetary business by enabling personalised providers tailor-made to every particular person’s wants and preferences. By leveraging superior algorithms and machine studying, AI can analyze huge quantities of buyer knowledge to create personalised experiences that drive buyer satisfaction and loyalty.

AI-Powered Advice Engines

AI-powered suggestion engines are a game-changer within the monetary business, providing personalised product and repair strategies primarily based on particular person buyer conduct and preferences. These engines use buyer knowledge to foretell what services or products a buyer could also be desirous about, resulting in a extra focused and related providing. This not solely enhances the shopper expertise but additionally will increase the chance of cross-selling and upselling alternatives for monetary establishments.

- Advice engines analyze previous transactions, searching historical past, and interactions to counsel related monetary services or products to prospects.

- By offering personalised suggestions, monetary establishments can enhance buyer engagement and loyalty, resulting in elevated buyer retention and lifelong worth.

- AI-powered suggestion engines can even assist prospects uncover new services or products that they might not have thought of, increasing their monetary portfolio and driving income for the establishment.

Predicting Buyer Conduct and Preferences

AI know-how allows monetary establishments to foretell buyer conduct and preferences precisely, permitting them to anticipate buyer wants and supply tailor-made experiences. By analyzing historic knowledge and buyer interactions, AI can forecast future conduct and preferences, enabling establishments to proactively handle buyer wants and supply personalised options.

- AI algorithms can predict when a buyer is more likely to make a selected monetary determination, similar to making use of for a mortgage or opening a brand new account, primarily based on their previous conduct and interactions.

- By understanding buyer preferences, monetary establishments can supply personalised promotions, reductions, or rewards that resonate with particular person prospects, rising engagement and satisfaction.

- Predicting buyer conduct additionally permits establishments to mitigate dangers by figuring out potential points or considerations earlier than they escalate, in the end enhancing the general buyer expertise and relationship.

Actual-time Assist and Help

AI know-how has revolutionized customer support within the monetary business by offering real-time help and help to prospects. AI chatbots are on the forefront of this innovation, providing instantaneous responses to buyer queries and points with out the necessity for human intervention. These chatbots are powered by machine studying algorithms that allow them to know and reply to buyer inquiries successfully.

AI Chatbots for On the spot Assist

AI chatbots are designed to simulate human interplay and supply correct and well timed responses to buyer queries. These chatbots can deal with a variety of buyer points, from account inquiries to transaction disputes, with effectivity and precision. By leveraging pure language processing capabilities, AI chatbots can perceive the context of buyer messages and supply related options in real-time.

- AI chatbots can deal with a big quantity of buyer inquiries concurrently, making certain immediate responses and lowering wait occasions for purchasers.

- Via steady studying and enchancment, AI chatbots can improve their accuracy and effectiveness in addressing buyer wants over time.

- AI chatbots can present constant service high quality, making certain that every one prospects obtain the identical degree of help whatever the time of day or night time.

AI-Powered Digital Assistants for Advanced Issues

Along with AI chatbots, monetary establishments are additionally utilizing AI-powered digital assistants to deal with extra complicated buyer issues that will require human-like reasoning and decision-making. These digital assistants can analyze massive quantities of knowledge, assess intricate situations, and supply personalised options to prospects in real-time.

- AI-powered digital assistants can supply personalised suggestions primarily based on particular person buyer preferences and behaviors, enhancing the general buyer expertise.

- By automating the decision of complicated points, digital assistants can unencumber human brokers to deal with extra strategic duties that require human creativity and empathy.

- Digital assistants can streamline the customer support course of, resulting in sooner challenge decision and improved buyer satisfaction ranges.

Benefits of AI in 24/7 Buyer Service Availability

One of many key benefits of AI know-how in customer support is its means to offer 24/7 buyer help, making certain round the clock availability for purchasers. AI-powered chatbots and digital assistants can function constantly with out the necessity for breaks, holidays, or shifts, enabling prospects to obtain help at any time of the day or night time.

- Clients can entry help instantaneously, no matter their location or time zone, resulting in elevated comfort and satisfaction.

- AI-driven customer support ensures that prospects obtain well timed responses to their inquiries, lowering buyer frustration and enhancing loyalty to the monetary establishment.

- 24/7 customer support availability will help monetary establishments differentiate themselves in a aggressive market by delivering superior buyer experiences and constructing long-term relationships with prospects.

Fraud Detection and Prevention

AI performs an important function within the monetary business by enhancing fraud detection and prevention measures, in the end safeguarding buyer accounts and knowledge.

Utilization of AI Algorithms

AI algorithms are used to research huge quantities of knowledge in real-time to detect any anomalies or suspicious actions that will point out potential fraud. These algorithms can establish patterns and tendencies that will go unnoticed by human analysts, enabling monetary establishments to take proactive measures to forestall fraudulent transactions.

Machine Studying Fashions for Fraud Identification

Machine studying fashions, similar to anomaly detection algorithms and predictive analytics, are generally utilized to research transaction patterns and buyer conduct. For instance, these fashions can detect deviations from regular spending patterns, flagging transactions which are inconsistent with a buyer’s common conduct. By constantly studying from new knowledge, these fashions enhance their accuracy over time, making them more practical in detecting fraudulent actions.

Enhancing Safety Measures

AI applied sciences additionally play a essential function in enhancing safety measures to guard buyer accounts and delicate knowledge. Via superior authentication strategies like biometric identification, facial recognition, and behavioral analytics, AI helps be certain that solely licensed customers have entry to their accounts. Moreover, AI-powered fraud detection programs can present real-time alerts to prospects and monetary establishments, enabling swift motion to mitigate potential dangers and stop monetary losses.