What Are The Regulatory Challenges Facing The Embedded Finance Industry?

Contents

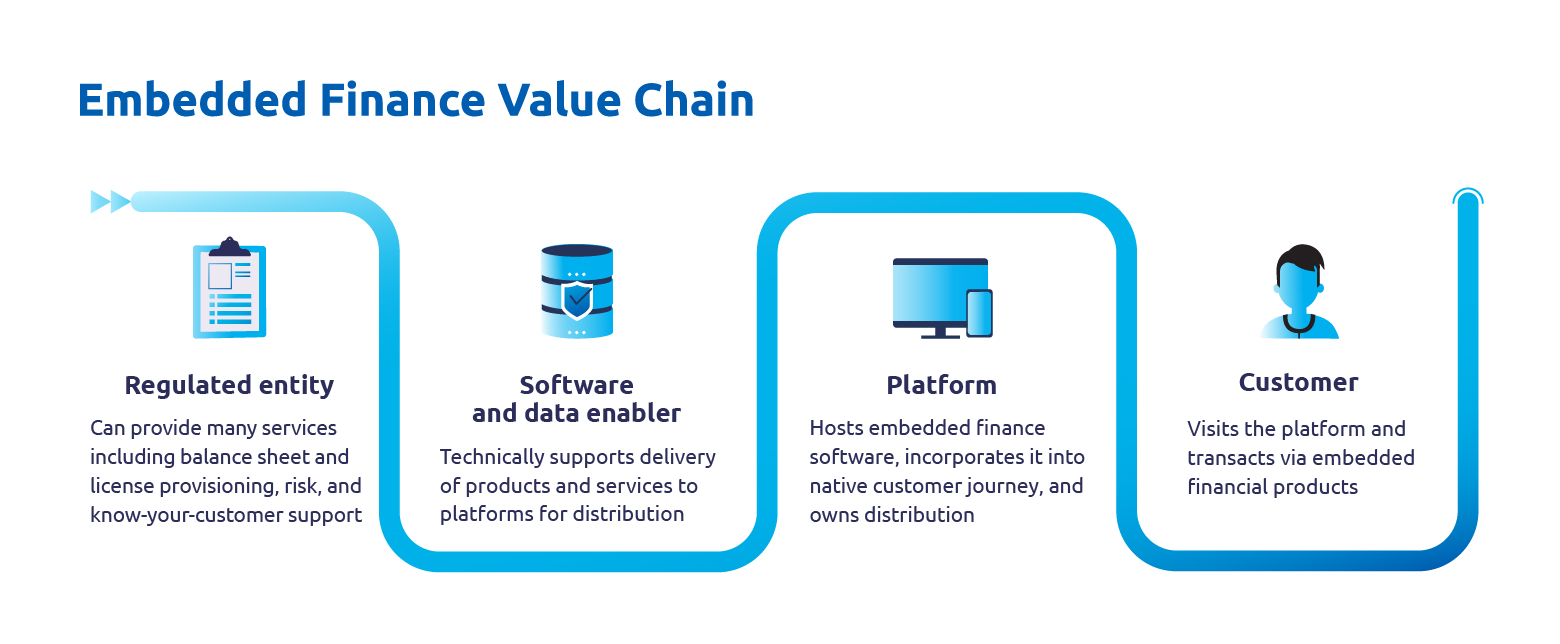

Overview of Embedded Finance Business Rules

What are the regulatory challenges dealing with the embedded finance trade? – Embedded finance, the place non-financial firms combine monetary companies into their choices, is a quickly rising sector. As with every trade involving monetary transactions, embedded finance firms should adhere to a fancy internet of rules to make sure shopper safety, monetary stability, and general compliance.

Present Regulatory Panorama

The regulatory panorama for embedded finance is multifaceted, with rules spanning numerous jurisdictions and sectors. Firms working on this house should navigate a variety of regulatory necessities to make sure compliance.

- Regulatory necessities could embrace information safety legal guidelines, anti-money laundering rules, shopper safety legal guidelines, and monetary companies rules.

- Firms should additionally contemplate rules particular to the monetary services they provide, resembling banking, lending, insurance coverage, or investments.

Key Regulatory Our bodies

A number of key regulatory our bodies oversee the embedded finance trade, guaranteeing that firms function inside the bounds of the regulation and cling to trade requirements.

| Regulatory Physique | Obligations |

|---|---|

| Client Monetary Safety Bureau (CFPB) | Defending shoppers within the monetary market, implementing compliance with federal shopper monetary legal guidelines. |

| Securities and Change Fee (SEC) | Regulating securities markets and defending traders. |

| Monetary Business Regulatory Authority (FINRA) | Regulating brokerage corporations and trade markets. |

Significance of Compliance

Compliance with monetary rules is essential for embedded finance firms to take care of belief with prospects, shield delicate information, and keep away from authorized repercussions.

- Non-compliance can result in fines, authorized motion, reputational harm, and lack of buyer belief.

- Adhering to rules additionally helps firms mitigate dangers, guarantee monetary stability, and foster a aggressive benefit out there.

Compliance Challenges: What Are The Regulatory Challenges Going through The Embedded Finance Business?

Navigating the regulatory panorama within the embedded finance trade generally is a daunting job as a result of complexities of adhering to diversified regulatory frameworks throughout completely different areas. Firms working on this sector should keep abreast of a mess of rules to make sure compliance and keep away from potential authorized pitfalls.

Affect of Totally different Rules

- Fee Companies Directive 2 (PSD2): Launched within the European Union, PSD2 mandates robust buyer authentication for on-line transactions, impacting cost processing in embedded finance.

- Client Monetary Safety Bureau (CFPB) rules in the USA require firms to reveal charges, phrases, and situations to shoppers, affecting transparency in embedded finance choices.

- Anti-Cash Laundering (AML) and Know Your Buyer (KYC) rules are globally enforced to stop monetary crimes, including compliance burdens on embedded finance platforms.

Implications of Non-Compliance

Non-compliance with regulatory necessities within the embedded finance sector can result in extreme penalties, together with authorized penalties, reputational harm, and operational disruptions. Firms failing to satisfy compliance requirements danger dealing with fines, lawsuits, and even suspension of their operations. It’s essential for companies within the embedded finance trade to prioritize compliance efforts to take care of belief with prospects and regulatory authorities.

Knowledge Privateness and Safety Rules

Because the embedded finance trade continues to develop, information privateness and safety rules play an important function in shaping how firms function and shield delicate info.

Affect of GDPR and CCPA on Embedded Finance Companies

- GDPR and CCPA impose strict guidelines on how firms gather, course of, and retailer private information.

- Embedded finance companies typically take care of delicate monetary info, making compliance with these rules important.

- Firms should guarantee transparency in information dealing with practices and acquire express consent from customers for information processing.

Challenges of Making certain Knowledge Safety in a Regulated Setting

- Assembly the necessities of a number of information privateness legal guidelines may be complicated and resource-intensive for firms providing embedded finance options.

- Making certain information safety in a extremely regulated surroundings requires sturdy cybersecurity measures and common audits to detect and mitigate potential vulnerabilities.

- Knowledge breaches can have extreme penalties, together with monetary losses, reputational harm, and authorized penalties.

Alignment with Knowledge Privateness Rules in Embedded Finance

- Firms can align with information privateness rules by implementing encryption protocols, entry controls, and information anonymization strategies to safeguard consumer info.

- Common coaching packages for workers on information safety insurance policies and procedures may help guarantee compliance with rules.

- Collaborating with authorized specialists and regulatory our bodies to remain up to date on evolving privateness legal guidelines and adapting inside processes accordingly is essential for sustaining regulatory compliance.

Licensing and Partnerships

In relation to providing embedded finance companies, firms want to stick to particular licensing necessities to make sure compliance with rules.

Licensing Necessities for Embedded Finance Companies, What are the regulatory challenges dealing with the embedded finance trade?

- Firms offering embedded finance companies usually have to get hold of licenses from related regulatory our bodies, resembling banking or monetary authorities.

- The particular sort of license required could differ relying on the character of the companies supplied, resembling funds, lending, or insurance coverage.

- Failing to safe the mandatory licenses may end up in extreme penalties, together with fines and even the suspension of operations.

Significance of Strategic Partnerships

- Strategic partnerships play an important function in serving to firms overcome regulatory hurdles within the embedded finance trade.

- By collaborating with established gamers within the monetary sector, firms can leverage their experience and regulatory compliance to navigate complicated regulatory frameworks.

- Partnerships may present entry to a wider buyer base and improve the credibility of firms providing embedded finance companies.

Collaborations with Conventional Monetary Establishments

- Partnering with conventional monetary establishments may help firms navigate regulatory challenges extra successfully.

- Conventional banks and monetary establishments have intensive expertise in complying with regulatory necessities and might present helpful steerage to firms coming into the embedded finance house.

- Collaborations with established establishments may assist construct belief with prospects and regulators, demonstrating a dedication to compliance and safety.